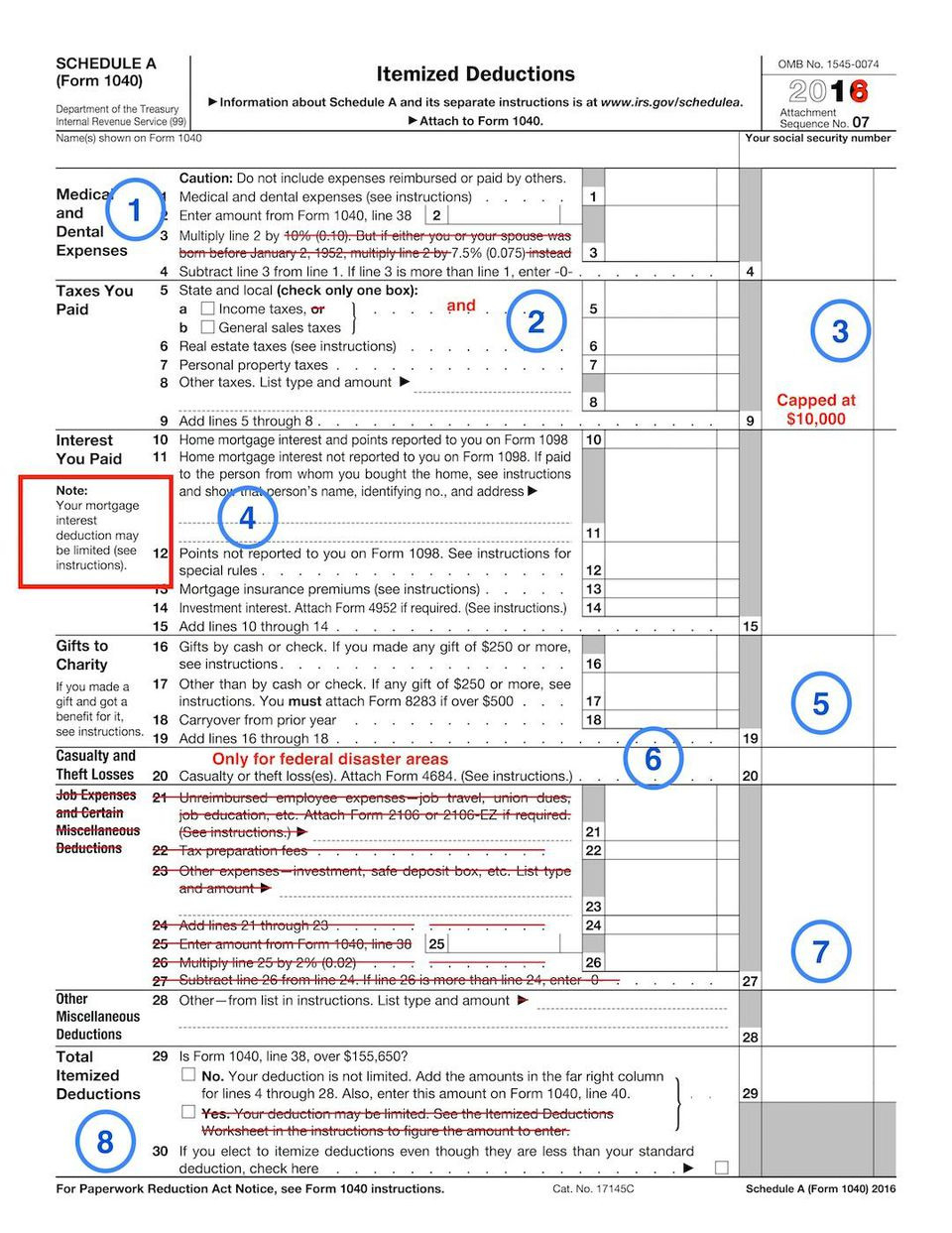

Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 . The irs updates the standard deduction amount each tax year to account for. See how to fill it out, how to itemize tax deductions and helpful tips. In most cases, your federal income tax will be less if you take the. The standard deduction reduces your taxable income to help lower your federal tax bill. The tax cuts and jobs act, passed in 2017, limited the. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction.

from lessonlibbrown.z21.web.core.windows.net

Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). If you elect to itemize deductions even though they are less than your standard deduction, check this box. See how to fill it out, how to itemize tax deductions and helpful tips. The tax cuts and jobs act, passed in 2017, limited the. In most cases, your federal income tax will be less if you take the. The standard deduction reduces your taxable income to help lower your federal tax bill. The irs updates the standard deduction amount each tax year to account for. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they.

Itemized Deduction Worksheet Excel

Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). The tax cuts and jobs act, passed in 2017, limited the. In most cases, your federal income tax will be less if you take the. The irs updates the standard deduction amount each tax year to account for. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. If you elect to itemize deductions even though they are less than your standard deduction, check this box. The standard deduction reduces your taxable income to help lower your federal tax bill. See how to fill it out, how to itemize tax deductions and helpful tips.

From www.youtube.com

Itemized Deductions Form 1040 Schedule A YouTube Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. The standard deduction reduces your taxable income to help lower your federal tax bill. In most cases, your federal income tax will be less if you take the. See how to fill it out, how to itemize tax deductions and. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From www.printabletemplate.us

Printable Itemized Deductions Worksheet Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. The tax cuts and jobs act, passed in 2017, limited the. See how to fill it out, how to itemize tax deductions and. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From greenbayhotelstoday.com

Itemized Deductions Definition, Who Should Itemize NerdWallet (2023) Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The standard deduction reduces your taxable income to help lower your federal tax bill. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. See how to fill it out, how to itemize tax deductions and helpful tips. The tax cuts and jobs act, passed in 2017, limited the. Schedule. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From vinitawsophi.pages.dev

Oregon State Standard Deduction 2024 Toma Kittie Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 If you elect to itemize deductions even though they are less than your standard deduction, check this box. The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. The tax cuts and jobs act, passed in 2017, limited the. See how to fill it out, how to itemize tax deductions and helpful tips.. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From vivapandora.pages.dev

What Is The Standard Deduction For 2024 In Ky Kayla Neilla Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 In most cases, your federal income tax will be less if you take the. Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). See how to fill it out, how to itemize tax deductions and helpful tips. If you elect to itemize deductions even though they are less than your standard deduction,. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From formspal.com

Itemized Deductions Checklist ≡ Fill Out Printable PDF Forms Online Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 See how to fill it out, how to itemize tax deductions and helpful tips. The tax cuts and jobs act, passed in 2017, limited the. The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. In most cases, your federal income tax will be less if you take the. Schedule a is an. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From printablelibscapus.z21.web.core.windows.net

Form 1065 Line 20 Other Deductions Worksheet Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The standard deduction reduces your taxable income to help lower your federal tax bill. In most cases, your federal income tax will be less if you take the. Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From maudeqvalerye.pages.dev

Itemized Deductions 2024 Form Zea Lillis Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. See how to fill it out, how to itemize tax deductions and helpful tips. The standard deduction reduces your taxable income to help. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From mauricelplacenciaxo.blob.core.windows.net

Standard Deduction 2022 Both Over 65 Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). The standard deduction reduces your taxable income to help lower your federal tax bill. If you elect to itemize deductions even though they are less than your standard deduction, check this box. The tax cuts and jobs act, passed in 2017, limited the.. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From ahuskyworld.blogspot.com

California Itemized Deductions Worksheet Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 In most cases, your federal income tax will be less if you take the. See how to fill it out, how to itemize tax deductions and helpful tips. The tax cuts and jobs act, passed in 2017, limited the. The irs updates the standard deduction amount each tax year to account for. Schedule a is an irs form used to. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From www.denizen.io

Printable Itemized Deductions Worksheet Customize and Print Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The tax cuts and jobs act, passed in 2017, limited the. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. The standard deduction reduces your taxable income to help lower your federal tax bill. If you elect to itemize deductions even though they are less than your standard deduction,. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From materialfulldelation.z13.web.core.windows.net

Itemized Deduction List Template Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The tax cuts and jobs act, passed in 2017, limited the. If you elect to itemize deductions even though they are less than your standard deduction, check this box. The standard deduction reduces your taxable income to help lower your federal tax bill. See how to fill it out, how to itemize tax deductions and helpful tips. Schedule a is. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From www.vitaresources.net

Itemize deductions Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The standard deduction reduces your taxable income to help lower your federal tax bill. The tax cuts and jobs act, passed in 2017, limited the. See how to fill it out, how to itemize tax deductions and helpful tips. The irs updates the standard deduction amount each tax year to account for. The standard deduction is a fixed number that. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From www.pinterest.com

Standard Deduction vs. Itemized Tax Deduction What's Better Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). In most cases, your federal income tax will be less if you take the. The standard deduction is a fixed number that taxpayers can deduct from their taxable income, and they. See how to fill it out, how to itemize tax deductions and. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From lessonschoolrepointing.z5.web.core.windows.net

General Sales Tax Deduction Worksheet 2022 Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the standard deduction. See how to fill it out, how to itemize tax deductions and helpful tips. The irs updates the standard deduction amount each tax year to account for. In most cases, your federal income tax will be less if you take. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From materialmediaonshore.z14.web.core.windows.net

Small Business Itemized Deductions Worksheet Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The tax cuts and jobs act, passed in 2017, limited the. The standard deduction reduces your taxable income to help lower your federal tax bill. Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather than take the. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From lessonlibbrown.z21.web.core.windows.net

Itemized Deduction Worksheet Excel Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 The irs updates the standard deduction amount each tax year to account for. See how to fill it out, how to itemize tax deductions and helpful tips. The tax cuts and jobs act, passed in 2017, limited the. In most cases, your federal income tax will be less if you take the. Schedule a is an irs form used to. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.

From bookstore.gpo.gov

2019 IRS Tax Form 1040 (schedule A) Itemized Deductions U.S Standard Deduction Or Itemized Deductions (Form Schedule A) 2022 If you elect to itemize deductions even though they are less than your standard deduction, check this box. In most cases, your federal income tax will be less if you take the. The irs updates the standard deduction amount each tax year to account for. Schedule a is the tax form used by taxpayers who itemize their deductible expenses rather. Standard Deduction Or Itemized Deductions (Form Schedule A) 2022.